ODOO ACCOUNTING

Odoo Accounting is a solution that streamlines financial management by centralizing all your accounting data within a single system. Its main strength lies in automation, allowing you to track your finances in real time without manual data entry. With seamless integration across various modules (sales, purchases, inventory, etc.), Odoo ensures a smooth and consistent workflow, minimizing errors and improving data accuracy.

You also get features tailored to your needs, such as invoice management, payments, tax reporting, and more. These tasks are fully automated, saving you time and enabling you to focus on growing your business. The intuitive interface makes it easy to use, even for those with little accounting experience.

Why choose Odoo Accounting?

Odoo Accounting is designed to optimize financial management for businesses. Its key advantage lies in its flexibility, you can tailor it to your specific needs, whether you have unique requirements or want to customize certain settings to better align with your business operations.

Unlike other software, Odoo stands out with its full integration across your entire management ecosystem (sales, purchases, inventory, CRM, etc.), ensuring a smooth and cohesive experience across all your processes. By centralizing data in a single system, Odoo not only minimizes the risk of errors but also provides a real-time, comprehensive view of your business.

With dedicated tools for invoice management, payments, and tax reporting, Odoo Accounting simplifies complex tasks, allowing you to save time and focus on growing your business. Its adaptability and user-friendly interface help you make more informed financial decisions with ease.

What are the main features of Odoo Accounting?

Odoo Accounting provides a range of tools to streamline financial management. From invoice tracking to tax reporting, each feature is designed to simplify daily accounting and enhance accounting processes.

Automatic bank synchronization

One of the first steps to seamless accounting management is bank reconciliation. Odoo simplifies this process by syncing your bank accounts with the software. This allows you to instantly view all transactions and update your accounting records without manual input.

Once connected to your bank, Odoo automatically imports your bank statements, matches them with transactions in the system, and helps you verify their accuracy.

Invoice creation and management

Creating invoices is effortless with Odoo. Whether handling customer or vendor invoices, the module lets you generate professional documents in just a few clicks. You can customize your invoices by adding your logo, payment terms, and even discounts for your customers.

Odoo also tracks your invoices in real time, showing their status, whether sent, viewed by the customer, paid, or overdue. You can even set up automatic reminders for late payments, making cash flow management easier without any extra effort.

Vendor invoice verification

To keep your accounts accurate, Odoo allows you to verify vendor invoices by comparing them with purchase orders and received goods. This ensures you only pay what you owe, and that all information is consistent.

This process helps prevent errors and keeps your accounting reliable.

Upcoming payment forecasts

To avoid unexpected cash flow issues, Odoo provides a payment forecasting tool. This feature helps you track outstanding invoices, due dates, and estimate future liquidity.

With this, you can anticipate expenses and manage cash flow more effectively based on payment schedules and invoice terms.

Multi-currency management

Odoo Accounting supports multi-currency transactions, making it an essential tool for businesses with international clients or partners. The module automatically integrates real-time exchange rates and adjusts your accounting entries accordingly.

This allows you to track currency gains and losses without manually recalculating each transaction.

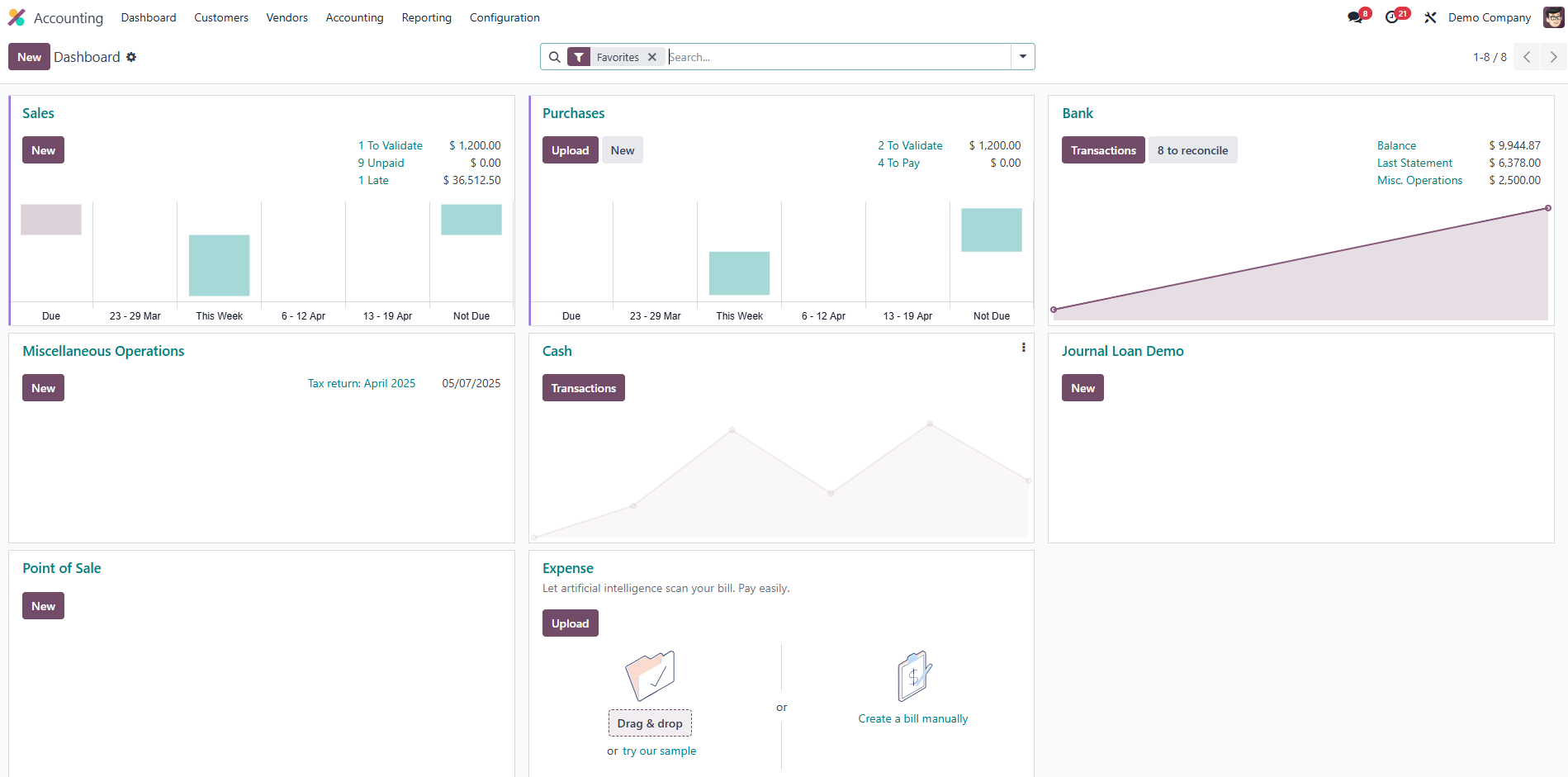

Custom dashboards

With Odoo, you can create custom dashboards that provide real-time insights into your accounts. Easily monitor customer receivables, vendor payables, and overdue payments.

These visual reports and key indicators help you make data-driven decisions quickly and efficiently.

Legal reporting compliance

Staying compliant with local tax regulations is crucial for any business. Odoo Accounting simplifies this by automating tax report generation. Whether it's VAT, corporate tax, or other specific legal requirements, Odoo ensures your tax filings are accurate and automated.

You can even submit tax reports directly from the Odoo interface, helping you meet deadlines effortlessly without administrative hassle.

Additional advanced features

Odoo also offers advanced functionalities such as analytical accounting and detailed expense and revenue management. You can track and analyze the costs and profits of your projects or departments while benefiting from seamless integration with other Odoo applications for fully centralized management.

This comprehensive approach helps you maintain a clear overview of your company's profitability and financial performance.

HOW DOES ODOO ACCOUNTING INTERACT WITH OTHER ODOO APPS?

One of Odoo’s biggest strengths is its seamless integration with other modules. This means all your financial data, from sales, purchases, and inventory, updates automatically, eliminating errors from duplicate entries.

Odoo Sales

With Odoo Accounting, sales and invoicing management becomes fully automated. As soon as a sale is recorded in the Sales app, an invoice is automatically generated in the accounting module, removing the need for manual data entry. This streamlines operations while minimizing the risk of errors.

You can track each invoice’s status in real time, whether sent, viewed, paid, or overdue. Odoo also lets you set up automatic reminders for late payments, helping you maintain healthy cash flow effortlessly. This integrated tracking system gives you clear visibility into your receivables and helps you optimize your financial management.

Odoo Purchase

Odoo simplifies purchasing and vendor management. When an order is placed, the supplier invoice can be automatically matched with the purchase order and the goods receipt. This integration ensures that you only pay what is due while verifying data accuracy.

Payment management is also automated, you can track due dates and have a clear overview of outstanding amounts, making it easier to manage your expenses.

Odoo Inventory

Odoo’s inventory management goes beyond simple stock tracking. Every stock movement is directly integrated into accounting, allowing automatic tracking of costs associated with goods and services. This gives you a complete and up-to-date view of product costs without manual calculations or data entry errors.

Whether you’re receiving products, shipping them, or transferring stock between warehouses, every transaction is automatically recorded in your accounting books.

Odoo Human Resources

Payroll management and employee-related expenses, such as expense reports, are seamlessly integrated into the accounting module. As soon as a salary is paid or an expense report is submitted, it is automatically recorded in the accounts. This ensures accurate and reliable bookkeeping while helping you stay compliant with tax and social regulations.

No more worrying about manual data entry errors or omissions, everything is synchronized in real time. This integration simplifies financial management for HR and allows you to better anticipate employee-related costs.

USE CASES FOR Odoo Accounting?

Odoo Accounting is a flexible solution that adapts to different types of businesses, regardless of their size or specific needs. Here are some key use cases where Odoo can be particularly beneficial:

Growing SMEs

For small and medium-sized enterprises experiencing growth, Odoo streamlines financial management by automating essential tasks such as payment tracking, invoicing, and tax reporting. This automation not only saves time for teams but also reduces the risk of human errors. With real-time insights into financial data, businesses can better manage cash flow and anticipate future needs.

International businesses

Companies operating globally benefit from Odoo's accounting capabilities, particularly in handling multi-currency transactions. The system automatically adjusts for exchange rate fluctuations and ensures that accounting entries align with different currencies. Additionally, Odoo helps maintain compliance with local tax regulations, simplifying international tax management and enabling the generation of financial reports that meet each country's legal requirements.

Startups and freelancers

For startups and independent professionals, Odoo Accounting simplifies daily bookkeeping. Its features, tailored for small businesses, automate tasks like invoice management and payment tracking while offering an intuitive user experience. This allows entrepreneurs to focus on growing their business while ensuring that their financial records remain up-to-date and compliant.

why choose captivea FOR Odoo Accounting integration?

Captivea is a recognized expert in Odoo integration, supporting businesses throughout the implementation of a tailored accounting solution. With our experience and personalized approach, we ensure that every Odoo Accounting feature aligns perfectly with your specific requirements.

We make sure the solution is adapted to your company's size and structure, ensuring efficient financial management. Beyond integration, we provide ongoing support and dedicated assistance to help you improve your accounting processes and maximize the benefits of Odoo.

DISCOVER HOW ODOO ACCOUNTING CAN STREAMLINE YOUR FINANCIAL MANAGEMENT

Contact us now for a free demo!

Odoo GOLD PARTNER |

Worldwide ERP solution |

Based Cloud ERP Solution or On Premise ERP Solution |

Prices per users |

Adapted for small businesses and mid-market businesses |

+40 000 apps availables on Odoo Marketplace |

Frequently asked questions

Odoo Accounting Software is a comprehensive solution designed to manage all aspects of financial accounting. It helps businesses stay compliant with their country's taxation regulations while ensuring efficient budget management, cash flow monitoring, and handling of accounts receivable and paid invoices.

Yes, Odoo ERP includes advanced payroll management features, allowing businesses to track salaries, deductions, and contributions efficiently. It also integrates with bank statements to provide an accurate overview of cash flow and schedule supplier payments.

Odoo Accounting Software helps generate detailed tax reports, provides a tax audit report, and allows businesses to configure fiscal positions to streamline fiscal administration and ensure compliance with financial regulations.

Absolutely! The system provides real-time accounting, ensuring that financial records are always updated. It can also automatically generate amortization entries, automate deferred revenue, and support automated billing cycles for consistent recurring revenue generation.

Yes, the system comes with multi-currency support, making it ideal for businesses operating globally. It also allows users to connect to a mobile banking application for easier mobile payment transactions and direct payments.

The software provides a robust invoicing system with attractive invoice templates and AI-powered invoice digitization for efficiency. It allows users to issue credit notes and set a total receivable amount limit to manage outstanding balances.

Odoo efficiently categorizes expense entries, links them to specific cost accounts for better tracking, and provides analytic distribution capabilities, allowing cost allocation based on business needs.

Yes, businesses can issue a vendor credit note directly within the system, process bank check deposits easily, and manage direct payments through various payment integrations.

The system simplifies invoice creation and customer invoice management by streamlining the entire process with automation, reducing errors, and ensuring timely payments.

Yes, Odoo can assign analytic accounts automatically based on predefined rules, ensuring precise financial tracking and better reporting.