Odoo Payroll

At Captivea, we know that payroll management is far more than just crunching numbers—it’s a strategic function that directly affects employee satisfaction and your company’s compliance every single day. With Odoo Payroll, you can break free from repetitive, time-consuming tasks thanks to a flexible, fully integrated solution designed around your real needs. Automate your payroll processes in a secure, user-friendly, and compliant environment, while centralizing your HR data for agile and efficient management.

Why use Odoo Payroll?

Payroll management often feels like a real headache when you’re juggling multiple tools or handling everything manually: fixing errors from miscalculated pay slips, chasing down missed filings, keeping up with ever-changing regulations, and racing against strict deadlines. It quickly turns into a stressful race that can lead to costly penalties—and to frustration within your HR team. What if all of this could be simple with Odoo Payroll?

Peace of mind in the face of payroll complexity

No more worrying about missing a legal update or overlooking a regulatory detail. With Odoo Payroll, mistakes and oversights are no longer inevitable—you benefit from a system that keeps up with changing rules, applies the right calculations automatically, and guides you through every situation. The result: compliant pay slips, simplified processes, and renewed confidence in every payroll you run.

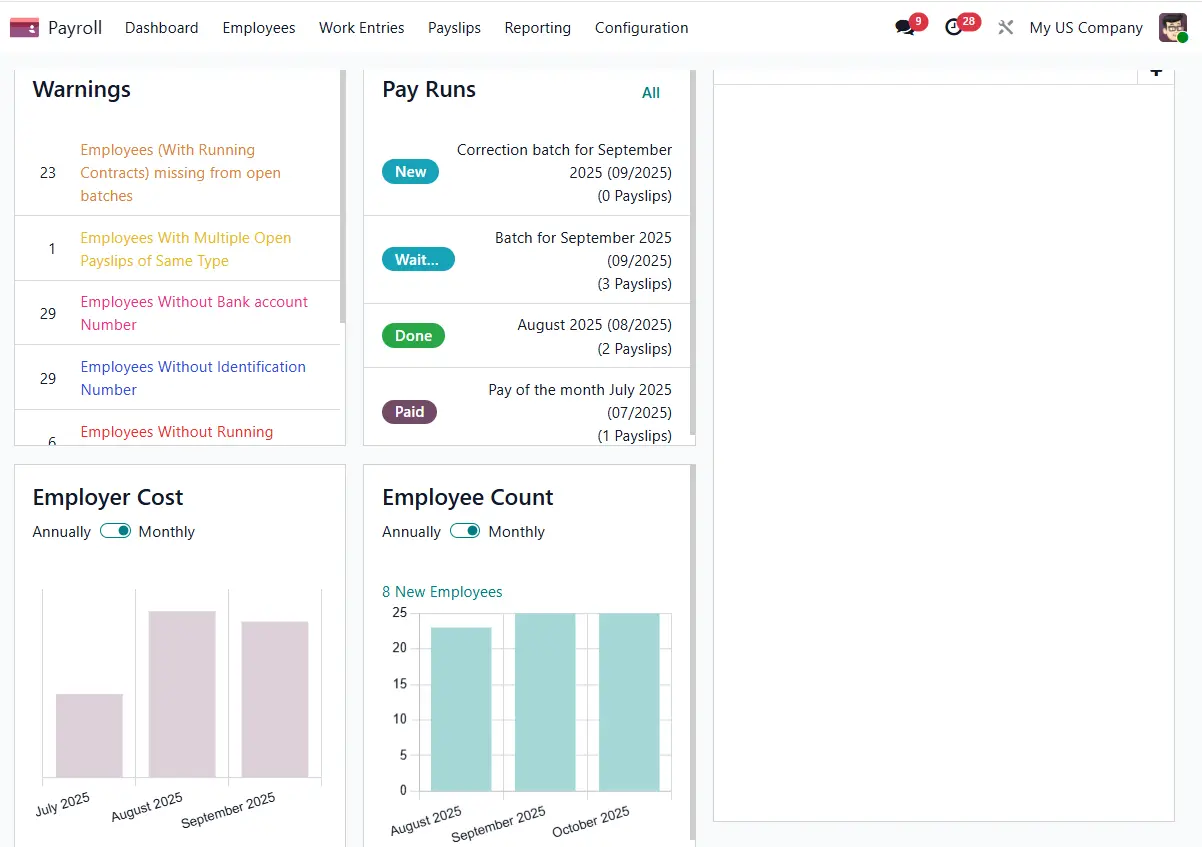

Centralize, control, master

Forget about scattered spreadsheets and missing information—manage all your payroll and HR data from one clear, unified interface. This centralization strengthens consistency, speeds up decision-making, and gives you real-time visibility into your workforce and costs—even across multiple entities or locations. Gain the clarity and responsiveness you need to manage your operations with confidence.

Free up time, value your talent

By relieving your teams from repetitive payroll tasks, Odoo Payroll frees up valuable time for high-impact initiatives. Instead of double-checking numbers and pay slips line by line, your HR professionals can focus on talent development, employee engagement, and improving internal processes. Payroll stops being a burden—it becomes a strategic driver for workforce engagement and business growth.

WHAT ARE THE KEY FEATURES OF Odoo Payroll?

Odoo Payroll offers a full range of features designed to simplify every step of payroll management and deliver truly modern HR oversight. Here are the highlights:

Easily automate and customize payroll calculations

Payroll accuracy starts with automation: Odoo handles all types of compensation while continuously adapting to your specific context.

- Manage different types of pay (fixed, variable, bonuses, overtime).

- Automatically apply salary rules, social contributions, taxes, and deductions based on local regulations.

- Account for contractual specifics and collective agreements.

Simplify contract management and tracking

Manage your teams and their career progression with ease thanks to centralized and flexible contract management.

- Create and track employment contracts (fixed-term, permanent, part-time, etc.).

- Define compensation policies by employee category.

- Adjust and modify salaries based on changes or developments.

Stay in control of work hours and absences

Ensure accurate, up-to-date payroll with precise tracking of work hours and absences, fully integrated with schedules.

- Manage paid leave, time-off, sick days, other absences, and overtime.

- Integrate with timesheets and clock-ins for precise calculations.

- Track balances and send automatic notifications.

Make payroll accessible and transparent for everyone

An intuitive employee portal puts every team member at the center of information, promoting autonomy and smooth workflows.

- Self-service access to pay slips and personal documents for employees.

- Secure viewing and downloading of pay statements.

- Streamlined communication between HR and employees.

Seamlessly connect payroll to your accounting

Odoo Payroll automates accounting entries for immediate and reliable financial tracking.

- Automatically create payroll-related accounting entries.

- Simplified export to accounting software or ERP systems.

- Detailed reports for financial management and compliance.

Manage all special cases and benefits with ease

Stay in control of every situation: perks, reimbursements, or special deductions are easily integrated into your payroll process.

- Administer benefits in kind, reimbursements, and wage garnishments.

- Customize payroll rules to meet specific needs.

- Track both variable and fixed elements.

Manage payroll expenses and allowances

Odoo Payroll simplifies the management of payroll expenses by integrating all related costs into your payroll process. This ensures accurate calculation and consistent accounting of every item. Key features include:

- Integration of allowances, bonuses, reimbursements, and other payroll expenses.

- Calculation aligned with salary rules and contract types.

- Support for various pay periods such as bi-weekly and weekly cycles.

- Automated tracking of payroll expenses alongside work entries and attendance.

- Detailed reports for accounting department reconciliation.

- Compatibility with diverse payroll systems and flexible salary structures.

Stay compliant and up to date

With Odoo Payroll, you can confidently meet all regulatory obligations thanks to tracking tools, reporting, and secure archiving.

- Generate monthly or annual reports and filings (IRS, Social Security, state payroll taxes, etc.).

- Secure data storage with full traceability.

- Automatic updates of legal and compliance rules.

How does Odoo Payroll interact with other Odoo Apps?

Payroll management doesn’t happen in isolation—it interacts with your entire HR and financial ecosystem. Odoo Payroll acts as a true orchestrator within the Odoo suite. See how it connects and streamlines your processes every day.

Odoo Employees

Achieve greater HR consistency through automatic employee synchronization. Profile, contract, or department creations and updates are instantly reflected in payroll. Absences, leave, work hours, and contract changes impact payroll automatically—no re-entry or oversights.

Odoo Accounting

Maintain financial control by linking your pay slips to accounting records. Payroll-related entries are automatically generated and posted for accurate and fast reconciliation. Data exports and reports simplify your tax and compliance obligations while consolidating your finances.

Odoo Timesheets

Ensure accurate compensation, aligned with actual work. With Odoo Payroll integrated to Odoo Timesheets, hours worked are fully reflected in pay slips and overtime calculations. Gain precise visibility into costs by project and team—essential for managing your operations.

Odoo Expenses

Make the reimbursement process transparent and easy to track. Approved reimbursements are automatically included in payroll, eliminating re-entry and errors. Employees can see reimbursements on their pay slips, while HR retains full traceability.

Odoo Recruitment

Streamline onboarding and the entire employee lifecycle. As soon as a new hire is onboarded, their data is ready for payroll and other HR modules. Maintain seamless information flow from application to the first pay slip.

With this natural integration, Odoo Payroll doesn’t just operate in isolation—it becomes a central hub, making HR, accounting, and administrative management far more efficient, responsive, and reliable for your entire team.

What are the use cases for Odoo Payroll?

Wondering if Odoo Payroll can meet your company’s needs? Discover how this solution flexibly adapts to different scenarios, making daily payroll management simpler and more efficient.

SMEs and startups

Are you a small business or a young company? Odoo Payroll lets you automate pay slips and tax filings while providing employees with simple, secure access to their pay statements through an intuitive portal. This way, you maintain full control over payroll while freeing up time to focus on growing your business.

Large enterprises and international groups

Managing payroll across multiple sites feeling complex? Odoo Payroll handles diverse collective agreements and local regulations while integrating with your accounting for reliable, consolidated reporting. Stay compliant and agile in the face of regulatory changes—without juggling multiple tools.

Regulated industries

Do you operate in a highly regulated sector—healthcare, legal, finance, construction, or others? Odoo Payroll helps you fully comply with all obligations, from on-call management to industry-specific bonuses, with complete traceability. Simplify audits and inspections through precise and secure payroll management.

Multinational organizations

Managing teams across multiple countries? Odoo Payroll centralizes your payroll management while ensuring compliance with local regulations. Gain a global overview, with reporting tailored to each jurisdiction, so you stay in control wherever your business operates.

Companies undergoing digital transformation

Looking to modernize your HR and financial processes? Odoo Payroll replaces manual methods with an integrated system that automates repetitive tasks and lets you track key metrics in real time. Empower your teams to be more strategic and responsive.

Why choose Captivea for Odoo Calendar integration?

Implementing a high-performance payroll solution means fundamentally transforming your company’s HR and financial management. But to unlock its full potential, it’s not enough to simply install software—you need to orchestrate the entire system and engage your teams in the change. That’s where Captivea makes the difference.

Choosing Captivea means a strategic, tailored approach:

- From the very first conversation, our experts take the time to analyze your processes, regulatory requirements, and business challenges to build a solution truly aligned with your reality.

- We deploy Odoo Payroll fully integrated with your existing environment—HR management, accounting, time tracking, reporting… everything communicates seamlessly, leaving nothing out.

- You receive proactive support at every stage—detailed configuration, team training, and ongoing, scalable assistance. We ensure your users fully adopt the tool and that the solution continues to meet your evolving needs.

Our approach? Transparency, Collaboration, and Excellence to ensure project success—whatever your industry or size:

- Over 16 years of experience with Odoo, and hundreds of successful ERP projects delivered in USA, Canada, France, Luxembourg and internationally.

- In-depth knowledge of payroll regulations and specific requirements for SMEs, mid-sized companies, and large enterprises.

- Odoo Gold Partner status in multiple countries, a mark of quality and trust.

With Captivea, choose a committed partner who can turn your Odoo Payroll project into a true engine of sustainable performance and organizational agility.

Optimize payroll management with Odoo Payroll by Captivea

Take control of your payroll management processes, boost efficiency, and simplify daily operations for your HR teams with a solution designed to address your everyday challenges. Odoo Payroll, implemented by Captivea, provides a comprehensive and scalable module, fully connected to all your Odoo applications. Ready to take the next step? Contact our experts for a personalized demo or an in-depth discussion about your needs.

Odoo GOLD PARTNER |

|

|

|

Worldwide ERP solution |

|

Based Cloud ERP Solution or On Premise ERP Solution |

|

Prices per users |

|

Adapted for small businesses and mid-market businesses |

|

+40 000 apps availables on Odoo Marketplace |

|

Discover Odoo ERP Schedule an Odoo Demo |

Frequently asked questions

Odoo Payroll is a comprehensive payroll app designed to streamline the entire payroll process. It automates salary calculations based on applicable salary rules and contract types, manages employee contracts, attendance, work entries, and extra hours, and handles payroll expenses to provide accurate net pay and timely payslips.

Whether you are a startup or a large enterprise managing complex salary structures, Odoo Payroll adapts to various business needs, supporting bi-weekly, weekly, or hourly pay periods, and flexible payroll systems tailored to your organization.

Yes, Odoo Payroll supports a wide range of applicable salary rules and is configurable to respect local laws, including handling unpaid leaves, allowances, and other deductions consistently across your payroll processes.

It seamlessly synchronizes employee information, payroll entries, and accounting department workflows. Integration with modules like Timesheets records work entry and attendance data that directly impact calculated salaries.

Absolutely. The payroll app allows you to set and fill detailed salary structures and salary rules, tailored to your contract types and internal policies, ensuring your payroll reflects your actual salary structure accurately.

Yes, employees can securely access their payslips through a dedicated portal anytime, providing transparency and empowering them with their payment details.

Odoo Payroll supports multiple languages and currencies, making it ideal for clients managing payroll across different regions with diverse salary structures.

The system generates consistent payroll entries and automated reports that can be exported to relevant authorities, making compliance straightforward and less time-consuming.

Yes, the payroll app incorporates allowances, bonuses, extra hours, and other payroll expenses into the salary structure, allowing comprehensive and accurate payroll calculations.

Employee information and payroll data are stored securely with controlled access and full audit trails, managed by responsible administrators and developers to maintain confidentiality.

Implementation timelines vary based on company size and complexity. Captivea works closely with clients to set payroll processes aligned with business needs and to ensure a smooth rollout respecting your pay period cycles.

Yes, we offer training tailored for HR and accounting teams, covering everything from work entry management to salary rule setup, to maximize efficient use of the payroll app.

Certainly. The system supports all contract types, adjusting salary calculations and payroll processes accordingly to match contract-specific rules and salary structures.

Work entries and attendance are fully tracked in the system; unpaid leaves and other adjustments are automatically reflected in the payroll, ensuring consistency through every pay period.

Yes, its modular architecture allows you to integrate additional features as your business grows, adapting payroll systems and salary rules flexibly to changing client needs.